#BANKING SYSTEM

Explore tagged Tumblr posts

Text

14 notes

·

View notes

Text

Regulatory Environment of Financial Institutions.

Financial regulations are laws and rules that govern financial institutions. Regulations of financial institutions focus on providing stability to the financial system, fair competition, consumer protection, and prevention and reduction of financial crimes. By the mid-1970s, the global financial system witnessed market-oriented reforms that led to liberalization in the financial system, such as the reduction of interest rate controls, removal of investment restrictions on financial institutions and a line of business restrictions, and control on international capital movements. The modern trend observed is that financial sector regulation is moving toward a greater cross-sector integration of financial supervision. In 1998, the adoption of the Basel Accord, which required international banks to attain an 8% capital adequacy ratio was a major significant milestone in banking regulations. The collapse of the global financial system that led to the global crisis can be attributed to the systemic failure of financial regulation. Basel I defined bank capital and bank capital ratio based on two-tier systems. The Basel II framework consisted of Part 1, the scope of application and three pillars, the first one being minimum capital requirements, the second one a supervisory review process, and the third pillar is market discipline. The Basel III framework prepared new capital and liquidity requirements for banks.

Learn more about Regulatory Environment of Financial Institutions related to the publication - Strategies of Banks and Other Financial Institutions: Theories and Cases.

#Financial regulations#Regulations of financial institutions#financial security#financial industry#financial markets#financial risk management#bank capital ratio#Basel Accord#interest rate controls#international capital movements#banking system#4 december#sustainable development goals#international day of banks

2 notes

·

View notes

Link

A few weeks ago, I was going to post two links, one about how wonderful Jamie Dimon of JPMorgan Chase was for helping rescue a bank that was in trouble, and the other of what was really happening. Here is an updated story on how it’s currently panning out. None of these sharks will help anyone unless there’s either money in it for them, or there’s a very good reason, and there lies the rub, all these banks are interconnected through derivatives, and that’s the real reason for the help, to stop the deck of cards from collapsing. If you want a good under the hood view of the troubled US banking system and why it’s worse than we’re told, this will give you a good understanding of the current situation.

https://wallstreetonparade.com/2023/04/banks-that-put-up-30-billion-to-rescue-first-republic-may-have-been-trying-to-rescue-their-own-exposure-to-247-trillion-in-derivatives/

2 notes

·

View notes

Text

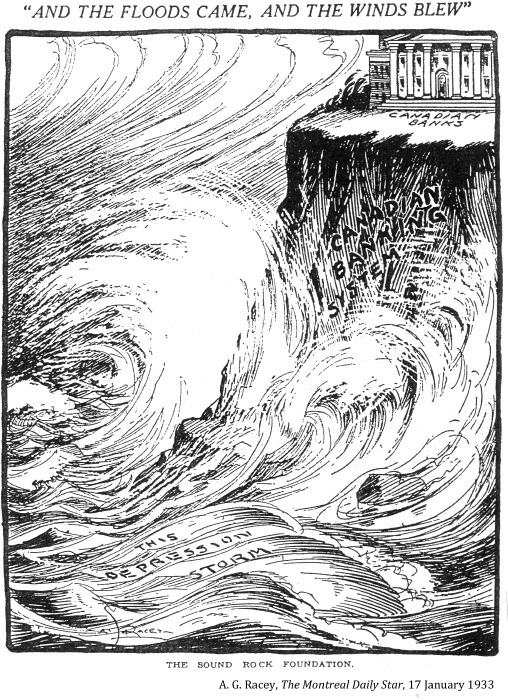

"AND THE FLOODS CAME, AND THE WINDS BLEW"," A. G. Racey, Montreal Star. January 17, 1933. ---- The DEPRESSION STORM crashes against the rocks of the CANADIAN BANKING SYSTEM, atop which sits serenely CANADIAN BANKS

#montreal#banking system#canadian banking system#financial capitalism#capitalism in canada#great depression in canada#capitalism in crisis#financial crisis#political cartoons

1 note

·

View note

Text

Indian Finance Expert Breaks Down the BRICS Payment System

Watch Now!

0 notes

Link

The idea of “Becoming Your Own Bank” sounds like something out of a Finance Experts dream—but “Your Own bank book” introduces the concept as a practical, achievable strategy. This book delves into a financial strategy called the infinite banking Concept (IBC), a system that utilizes a specially structured whole life insurance policy to create your very own banking system. In a world where traditional banking leaves little room for individual Financial Autonomy, the vision empowers people to take control of their personal finances, maximize liquidity, and avoid relying on external Financial Institutions.

#bank#banker#Banking#bank on yourself#bankers#Your Own Bank#your own banker#financeexperts#Finance Experts#ibc#infinite banking concept#wholelifeinsurance#whole life insurance#whole life insurance policy#financialautonomy#financial autonomy#banking system#bankingsystem#personalfinances#personal finances#personalfinance#personal finance#Financial Institutions#financialinstitutions

0 notes

Text

An Overview of Hong Kong's Banking System: Types of Banks and Their Roles

As a global financial hub, Hong Kong offers a diverse and dynamic banking landscape designed to serve individuals, businesses, and investors. From traditional retail banks to innovative virtual banks, the city’s financial institutions provide a wide range of services. This guide will explore the various types of banks in Hong Kong and explain how MCKALLEN can help businesses navigate the financial ecosystem, including services like Hong Kong bank internet banking, money transfer services, and more.

Hong Kong’s Banking System: Stability and Innovation

Hong Kong's banking system is known for its stability, efficiency, and innovation. The Hong Kong Monetary Authority (HKMA) ensures that banks operate under strict regulatory guidelines regarding risk management, governance, and capital adequacy, making the system secure and efficient. With a combination of traditional and emerging institutions, Hong Kong’s banking sector continues to evolve, offering numerous options for individuals and businesses alike. Understanding the different types of banks is crucial for selecting the right services, whether you’re interested in bank account opening in Hong Kong or exploring the best online bank accounts.

Types of Banks in Hong Kong

1. Retail Banks: Supporting Personal Financial Needs

Retail banks are the backbone of personal banking in Hong Kong. They offer a broad range of services such as savings accounts, loans, mortgages, credit cards, and essential money transfer services. Retail banks are adapting to the digital era by offering Hong Kong bank internet banking, allowing customers to manage their accounts, pay bills, and make transfers from anywhere. Whether you're considering Citi bank account opening or exploring other banks, retail institutions provide the convenience of both branch and online services for everyday banking.

2. Corporate Banks: Driving Business Success

Corporate banks in Hong Kong are essential for businesses of all sizes. They provide business accounts, commercial loans, trade finance, and cash management solutions that support the growth and operations of companies. Corporate banks are vital for businesses engaged in international trade, offering money transfer services and financial tools to help businesses manage cash flow and capital needs. Hong Kong's role as a global trading hub ensures that corporate banks are well-equipped to handle the demands of companies operating across borders.

3. Investment Banks: Enhancing Wealth and Strategy

Investment banks in Hong Kong focus on wealth management and financial advisory services for high-net-worth individuals, institutional investors, and corporations. They offer investment strategies, securities trading, and advisory services for mergers and acquisitions. These banks play a key role in facilitating wealth growth and strategic investments, making them critical for those seeking to optimize their financial portfolios and participate in large-scale deals.

4. Virtual Banks: A Digital-First Approach

Virtual banks are transforming Hong Kong’s banking landscape by offering a fully digital experience. With no physical branches, these best online banks provide services like mobile banking, online account management, and innovative financial products. Virtual banks are attractive to tech-savvy individuals and businesses due to their convenience, lower fees, and easy access to the best online bank accounts.

MCKALLEN: Helping Businesses Navigate Banking

MCKALLEN is a leading financial advisory service in Hong Kong that helps businesses find the right banking solutions. Whether your company needs assistance with bank account opening, securing financing, or managing liquidity, MCKALLEN’s expertise in the local banking ecosystem ensures businesses are matched with the right banking partners. Their personalized approach helps businesses streamline operations and optimize financial strategies in Hong Kong's competitive market.

#bank account opening#setting up business in hong kong#hong kong company formation and incorporation services#banking system#hong kong banks

0 notes

Text

🤔🧐

#wealthy#wealth#rich#rich people problems#rich people#top 1%#top one percent#life insurance#life hacks#money hack#is this true#financial education#financial#financial wellness#financial well being#research#is this true?#life#life insurance policy#leverage#banks#banking institutions#banking#banking system#can someone explain#can someone confirm#confirmed#confirmation#life lessons#life lesson

0 notes

Text

Payment service provider in India | Connected Banking (CIB) providers | Zyro

Discover Zyro, the leading Payment Service Provider in India, revolutionizing financial transactions with our cutting-edge Connected Banking (CIB) solutions. Streamline your business operations with seamless, secure, and efficient payment processing.

get more info :- www.zyro.in/blog/

#banking#connected banking#kpmg connected banking#icici connected banking#keeping banking connected#kpmg connected enterprise for banking#connected bank#connected world#digital agile banking services#corporate banking#banking system#open banking#accounting and banking

0 notes

Text

Automaattinen Tienaaminen - ONPASSIVE Digital Blueprint

ONPASSIVE Digital Blueprint. The research paper discusses the recent developments and future prospects of ONPASSIVE, a marketing business. It emphasizes the importance of understanding the business model and marketing platform within ONPASSIVE. The paper highlights the introduction of OConnect, traffic allocation, new products, and upcoming announcements by CEO Mr. Ash Mufareh. It underscores the…

View On WordPress

#advertising#AI cloud computing#banking#banking system#charge#Commissions#credit cards#customers#data center#digital#digital blueprint#domain#domains#early birds#fees#Finance#global markets#income streams#lifestyle#market#OConnect#ONPASSIVE#onpassive credit cards#ONPASSIVEaffiliate#revenue#traffic#traffic allocation#websites

0 notes

Text

Strategies and Structures of Financial Institutions.

A financial sector comprises a set of institutions, instruments, and markets established in the context of a legal and regulatory framework. Financial institutions face challenges for gaining competitive advantage in the context of rapid changes in technological, economic, social, demographic, and regulatory environments. The deep transformation of the financial sector is witnessing can be attributed to a number of factors such as technology innovation, deregulation, worldwide consolidation and restructuring, deregulation, and changing demographic profiles. Information technology is the primary force that keeps the financial industry dynamic. The post-economic crisis witnessed a series of policy reforms initiated by regulatory authorities. The global technology trends in the financial industry indicate the relevance of next-generation remote banking solutions, business intelligence, and analytics in transaction monitoring. Financial institutions face much complexity in the types of risks they have to manage. The trends indicate the growing significance of the emerging Asia market, consisting of China, India, and ASEAN countries for growth opportunities in the financial services industry.

Learn more about Strategies and Structures of Financial Institutions related to the publication - Strategies of Banks and Other Financial Institutions: Theories and Cases.

#Financial institutions#remote banking solutions#business intelligence#transaction monitoring#financial services industry#international day of banks#4 december#banks#banking system

0 notes

Text

Banking's future is digital, and software is the game-changer. From fintech's rise post-2008 to the power of UI/UX, investors need to tune in. Discover the opportunities in banking tech's evolution.

0 notes

Link

Creating a private banking System Using an insurance policy as a Source of Liquidity. In today’s world, many people seek #financialindependence and strategies to build wealth. One powerful tool for gaining financial control is the creation of a private banking system.

#private banking#private banking system#insurancepolicy#life insurance policy#buildwealth#build wealth#banking system

0 notes

Text

Making this a random PSA since I’d never heard about this until I encountered it:

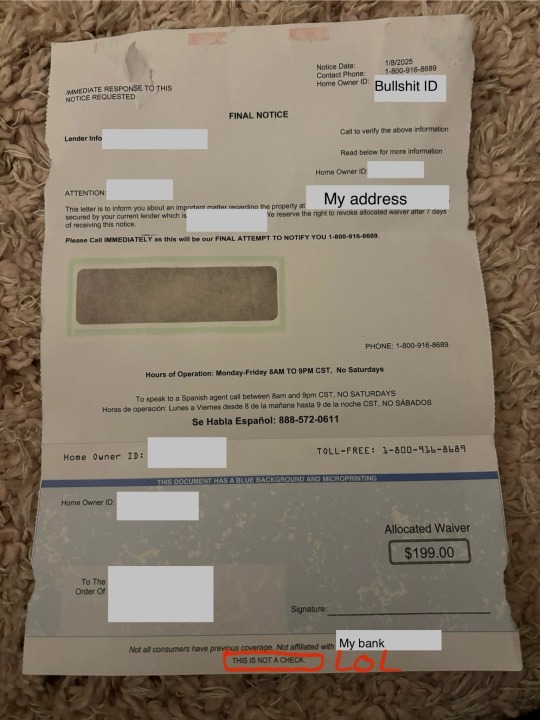

When you close on a house, you will receive scare-mail from scammers that use a lot of alarming language and look like they’re from your bank. These are scams.

Mortgage information is public information. So these scammers will have access to your name, your address, and the name of the bank your mortgage is with.

They love to send vague letters that explain nothing but make it SOUND like you’re in trouble if you don’t call them

And if you they can’t win you over with scare tactics, they’ve attached a not-a-check to maybe make you think they’ll give you money.

I blurred out my personal info but actually I WILL include the phone number, in the hopes that people who receive a letter like this and Google the number might see this info. Scam number is 1 800 916 8689

So if you see this kind of letter, or your parents, or grandparents, or loved ones, it’s a scam.

I told Patches she can eat it

#scam#Chrissy speaks#first time I got one of these overlapped with my bank messing up my address#so my mail from them was lost in the system#and I was anxiously waiting for my mortgage bill that was getting close to overdue#and which hadn’t come yet despite my bank claiming they sent it#so when I got one of these I DID call the number#realized it was a scam once I started talking to someone#but it pissed me off

890 notes

·

View notes

Text

Data Modernization and AI in Banking: Revolutionizing the Industry

Data modernization & AI have recently revolutionized the banking sector, allowing banks to work more effectively, and deliver superior customer experiences which help in making more informed decisions. There are some positive impacts of data modernization on the banking industry.

Source:

1 note

·

View note

Text

MICHAEL HUDSON ON BRICS DE-DOLLARIZATION, THE BANKING CRISIS, AND MULTIPOLARITY

Watch Now!

View On WordPress

0 notes